Best Cloud Mining Sites in 2025: Secure, Profitable, and Beginner-Friendly

Introduction

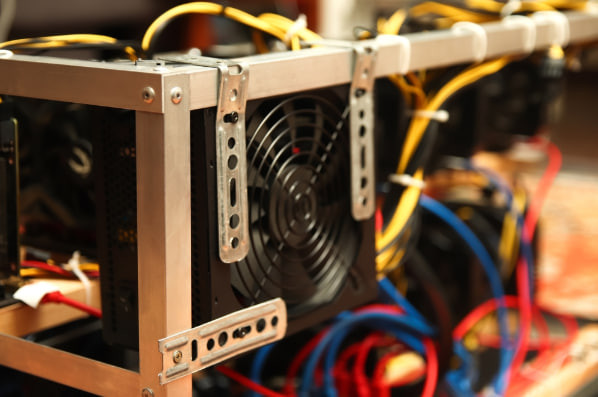

Cryptocurrency has captured the imagination of millions, but traditional mining remains out of reach for most people. The idea of setting up rows of expensive equipment in your home, dealing with constant noise, managing heat problems, and watching your electricity bill skyrocket isn't exactly appealing. That's where cloud mining comes in – offering a practical solution that lets you participate in cryptocurrency mining without owning any hardware.

Cloud mining websites have transformed how ordinary people can earn cryptocurrency. Instead of investing thousands in equipment that becomes outdated within months, you simply rent mining power from professional operations. These companies have already built massive data centers in locations with cheap electricity, and they handle all the technical complexities while you collect your share of the mining rewards.

But here's the reality check: not every cloud mining platform delivers on its promises. The industry includes both legitimate operations and questionable services that might disappoint or even scam unsuspecting users. Some platforms charge hidden fees that eat away profits, others exaggerate potential returns, and a few simply vanish with users' investments.

Finding the best cloud mining website requires understanding what separates quality services from problematic ones. You need platforms that prioritize security, offer transparent operations, provide reasonable profitability, and cater to beginners who are just starting their cryptocurrency journey. This guide will help you navigate the cloud mining landscape of 2025, focusing on secure, profitable options that welcome newcomers while protecting their investments.

What Makes a Cloud Mining Website "Best" in 2025?

The term "best" means different things to different people. A day trader might prioritize quick withdrawals, while a long-term investor values stability. However, certain qualities universally define top-tier cloud mining services.

Security Above Everything Else

Security isn't optional it's fundamental. The best cloud mining websites implement multiple layers of protection for both your investment and personal information. This includes:

-

Account security measures like two-factor authentication and biometric login options

-

Data encryption protecting information transmitted between your device and the platform

-

Secure storage for mined cryptocurrency until withdrawal

-

Regular security audits by independent firms

-

Insurance coverage protecting against platform breaches or hacks

Never compromise on security features. A platform might offer attractive rates, but if it can't protect your assets, those rates become meaningless when hackers drain your account.

Transparent Operations and Proof of Mining

Legitimate cloud mining platforms don't hide their operations. They provide concrete evidence that actual mining is occurring, not just shuffling money between users in a Ponzi scheme structure.

Quality platforms offer:

-

Verifiable wallet addresses showing mining pool activity

-

Real-time dashboard statistics displaying your hash power contribution

-

Data center information including locations and equipment types

-

Mining pool connections you can independently verify

-

Regular operational updates through blogs or newsletters

"Transparency isn't just about building trust – it's about accountability. Platforms that operate in the shadows typically have something to hide." – Cryptocurrency Industry Analyst

If a cloud mining website refuses to provide mining proof or becomes defensive when asked, consider that a major warning sign.

Profitability That Makes Sense

The best cloud mining website options balance competitive pricing with realistic return expectations. They don't promise overnight riches or guaranteed profits – those claims signal scams.

Instead, quality platforms:

-

Display clear fee breakdowns covering all costs

-

Provide accurate calculators using current market data

-

Show historical performance of existing contracts

-

Explain factors affecting profitability like difficulty adjustments

-

Offer multiple contract options for different budgets and goals

Calculate your potential break-even point before investing. If a platform's own calculator shows you'll need improbably favorable conditions to profit, look elsewhere.

Beginner-Friendly Features

Starting with cloud mining shouldn't require a computer science degree. The best platforms make the process straightforward for newcomers while offering advanced options for experienced users.

Look for these beginner-friendly elements:

|

Feature |

Why It Matters |

What to Look For |

|

Simple Registration |

Quick account setup |

Email verification, no excessive KYC requirements initially |

|

Intuitive Dashboard |

Easy monitoring |

Clear graphics, simple navigation, mobile-friendly design |

|

Educational Resources |

Learning support |

Guides, FAQs, video tutorials explaining cloud mining basics |

|

Low Minimum Investment |

Accessible entry point |

Starting options under $100 to test the platform |

|

Responsive Support |

Help when needed |

Multiple contact methods, reasonable response times |

|

Trial Options |

Risk-free testing |

Free mining power or money-back guarantees |

A cloud mining service confident in its product makes it easy for beginners to start small, learn the ropes, and scale up as they gain confidence.

Understanding Different Cloud Mining Models

Not all cloud mining websites operate identically. Understanding the various business models helps you choose platforms aligned with your preferences.

Direct Hash Power Rental

The most common model involves purchasing or renting hash power for a specific period. You pay upfront for mining capacity, and the platform distributes rewards proportional to your contribution. This model offers:

-

Predictable costs with fixed contract prices

-

Scalability through multiple contract purchases

-

Clear performance metrics showing your contribution

-

Passive income requiring minimal ongoing involvement

The downside? Your profitability depends entirely on the platform's efficiency and market conditions beyond your control.

Shared Mining Pool Participation

Some cloud mining platforms pool resources from multiple users, then distribute rewards based on contribution percentages. This approach provides:

-

Lower entry barriers with smaller minimum investments

-

Community aspects connecting with other miners

-

Potentially better returns through optimized pool strategies

-

Reduced individual risk from mining variance

However, pool-based cloud mining services sometimes lack transparency about total pool composition and individual contribution calculations.

Hybrid Ownership Models

Emerging platforms offer hybrid approaches where you partially own mining equipment operated by the company. This model combines cloud mining convenience with some benefits of traditional mining:

-

Hardware ownership giving you an asset with resale value

-

Greater transparency about your specific equipment

-

Potential tax advantages depending on jurisdiction

-

Equipment upgrade options as technology advances

The trade-off involves higher initial costs and potentially longer commitment periods than simple hash power rental.

Key Security Features to Demand

When evaluating cloud mining websites, security features should be non-negotiable. Here's what separates secure platforms from vulnerable ones.

Multi-Factor Authentication Options

Beyond basic passwords, top cloud mining platforms offer multiple authentication methods:

-

Two-factor authentication (2FA) through apps like Google Authenticator or Authy

-

Biometric verification using fingerprints or facial recognition on mobile apps

-

Hardware security keys for the highest protection level

-

Email confirmations for critical account changes

-

IP address monitoring flagging unusual access patterns

Enable every available security feature. Convenience matters less than protection when your investment is at stake.

Withdrawal Security Protocols

The moment you request withdrawals, security becomes critical. The best cloud mining website platforms implement:

-

Withdrawal whitelisting allowing transfers only to pre-approved addresses

-

Mandatory waiting periods giving you time to cancel unauthorized withdrawals

-

Progressive authentication requiring additional verification for large amounts

-

Transaction notifications alerting you immediately of withdrawal attempts

These measures might feel inconvenient initially, but they've saved countless users from devastating losses.

Platform Infrastructure Protection

Beyond individual account security, quality cloud mining services protect their entire infrastructure:

-

DDoS mitigation preventing service disruptions from attacks

-

Cold storage keeping most cryptocurrency offline and unreachable by hackers

-

Regular backups ensuring data recovery after any incident

-

Penetration testing identifying vulnerabilities before attackers do

-

Bug bounty programs rewarding security researchers who find weaknesses

Research whether your chosen platform has experienced security breaches. While past problems aren't automatic disqualifiers, how the company responded reveals their security commitment.

Evaluating Profitability Factors

Success with cloud mining requires understanding what drives profitability. Several interconnected factors determine whether your investment generates returns or losses.

Cryptocurrency Market Conditions

The cryptocurrency market's volatility directly impacts cloud mining profitability. When Bitcoin or other mined coins surge in value, your rewards become more valuable even if you're mining the same amount. Conversely, price crashes can turn profitable contracts into money-losers.

Smart miners monitor:

-

Current cryptocurrency prices across all coins they're mining

-

Historical price trends to identify patterns and cycles

-

Market sentiment indicators suggesting upcoming movements

-

Macro economic factors influencing overall crypto valuations

Remember that cloud mining platforms can't control market prices. Even the best platform can't guarantee profits during extended bear markets.

Network Mining Difficulty Adjustments

As more miners join a cryptocurrency network, mining difficulty increases to maintain consistent block production times. This means your fixed amount of hash power generates fewer coins over time.

|

Time Period |

Mining Difficulty Trend |

Impact on Returns |

|

Bull Market |

Rapid increases (20-40% annually) |

Declining coin generation rate |

|

Bear Market |

Slower growth or decreases |

Stable or improving generation rate |

|

Network Upgrades |

Can vary dramatically |

Unpredictable short-term effects |

The best cloud mining websites provide historical difficulty data and projections helping you anticipate these changes.

Fee Structures and Hidden Costs

Every cloud mining service charges fees, but transparency about these costs varies dramatically. Common fees include:

-

Maintenance fees: Daily charges covering electricity and equipment upkeep

-

Pool fees: Percentage taken by mining pools (typically 1-3%)

-

Withdrawal fees: Charges for transferring cryptocurrency to your wallet

-

Contract fees: One-time purchase charges separate from hash power cost

-

Performance fees: Additional charges if mining proves unusually profitable

Calculate your net profitability after all fees. Some platforms advertise low contract prices but compensate with aggressive maintenance fees that eliminate profits.