Best Cloud Mining Platforms in 2025: Secure Your Digital Mining Journey

Introduction

By the year 2025, the world of digital mining has changed significantly, with cloud mining services becoming the final choice of newcomers and experts in the field of cryptocurrency. Identifying the most appropriate cloud mining site involves knowing the layered ecosystem of the legitimate operators, the security measures and profitability in a business that has made tremendous improvement over the last decade or so.

Cloud mining will remove the old barriers that previously restricted the access to cryptocurrency mining to tech-savvy enthusiasts with deep pockets. Current cloud mining systems include turnkey offerings that enable any individual to engage in the mining of Bitcoin, Ethereum, and altocoins without having to spend money on costly hardware purchases, complicated software setups, or astronomical power and electricity bills.

The popularity of cloud-based mining is not limited to convenience only, it is a complete change in paradigm of cryptocurrency mining democratization which makes the mining experience available to all people, even those who do not consider themselves to be tech-savvy enough or risk-averse enough to possess hardware and get an experience of how digital assets are generated without the underlying technical and financial cost.

The Evolution of Cloud Mining in 2025

Cloud mining has become a mass financial product that draws millions of users globally as opposed to a niche investment opportunity. The operators of the best cloud mining websites have improved their business models, transparency and security to respond to the increasing demand of the retail and institutional investors.

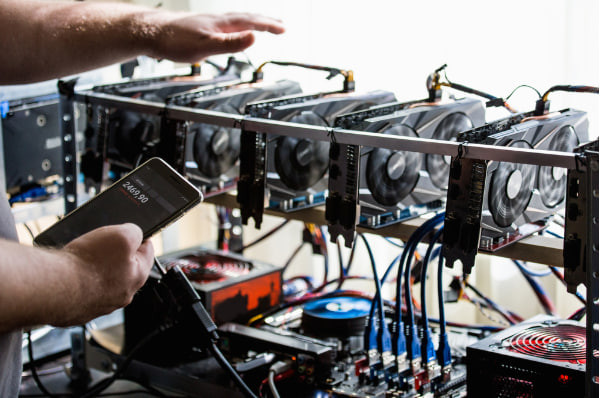

Contemporary cloud mining markets have advanced data centers with advanced ASIC miners and GPUs that yield regular returns to the holders of contracts. The advantages of these facilities include economies of scale, professional management, and strategic locations that have low electricity prices, and have favorable regulatory conditions.

As an industry matures, it has been facing more regulatory attention and compliance demands, with the legitimate operators and fly-by-wire schemes being divided. The existing cloud mining services have developed the appropriate licensing, have established effective security measures, and have developed transparent reporting that forms trust to the communities of their users.

Key Market Developments

Several significant developments have shaped the cloud mining industry in 2025:

-

Enhanced regulatory frameworks providing clearer operational guidelines

-

Improved transparency through real-time mining facility monitoring

-

Integration with renewable energy sources for sustainable operations

-

Advanced AI algorithms optimizing mining efficiency and profitability

-

Institutional-grade security measures protecting user investments

-

Mobile-first platforms enabling management from anywhere

Such changes have made cloud mining investments to become more reliable and confident as well as retain the ease and accessibility that made people join such resources in the first place.

Leading Cloud Mining Platforms for 2025

IQ Mining: Innovation Meets Reliability

The combination of innovative technology, open operations and competitive pricing models have made IQ Mining a leading cloud mining provider. Contracts are available to mine over 12 cryptocurrencies on the platform and the user can diversify their mining portfolio depending on the market conditions and their preferences.

Their most interesting characteristic is that they have an exclusive profit-switching algorithm that automatically picks the most profitable coins to mine in real-time according to the market and network difficulty changes. This automatic optimization helps users to maximize their returns without having to keep a close eye on market situations and manually optimizing their mining allocations.

The user interface of the platform enables users to complete analytics dashboard where they can view mining performance, daily earnings, and historical profitability trends. The transparency of IQ Mining is ensured by the routine facility tours and comprehensive operational reports showing that they have real mining operations.

StormGain: Integrated Trading and Mining

StormGain stands out with its ability to integrate the cloud mining experience with a complete-fledged cryptocurrency trade platform which provides a fully-fledged digital asset management ecosystem. Users have the option of mining Bitcoin straight in their trading account and withdrawing their gains instantly to use in trading or withdraw to their wallets.

The combined nature of the platform removes delays and complexities that usually come with the transfer of mining rewards across services. Cloud mining offered by StormGain works out of the box as the users continue trading, developing various revenue streams in the same platform.

Their mobile app enables users to access both mining and trading features without any hustle and utilize their apps to monitor their mining, trade, and manage their crypto-holdings anywhere where there is an internet connection.

Ecos Mining: Enterprise-Grade Solutions

Ecos Mining aims at attracting serious investors who have enterprise level of cloud mining contracts which are supported with industrial scale mining. It has individual and institutional investment options, and the minimum size of the contract is meant to ensure it has long-term investors and not the casual speculators.

Their professional style involves high-level due diligence procedures, institutional level reporting, and direct communication with the managers of mining facilities. Ecos Mining offers a visibility of their mining activities, which has never been seen before and this is due to the use of live facility cameras and real-time equipment monitoring systems, which investors like.

The institutional-focused nature of the platform has led to improved levels of security, compliance with the rules, and financial reporting that is beyond the standards set by the industry.

Platform Security and Trust Assessment

|

Platform |

Security Rating |

Verification Methods |

Operational History |

User Reviews |

|

IQ Mining |

A+ |

SSL, 2FA, Cold Storage |

5+ Years |

4.6/5 Stars |

|

StormGain |

A |

SSL, KYC, Multi-Sig |

4+ Years |

4.3/5 Stars |

|

Ecos Mining |

A+ |

Enterprise Security |

6+ Years |

4.7/5 Stars |

Ecos Mining focuses on serious investors to take on enterprise-level cloud mining commitments supported with industrial size mining operations. The site provides individual and institutional investments and the minimum contract value is made to appeal to long-term investors as opposed to casual investors.

Their working method has a comprehensive due diligence procedures, institutional grade reporting and communicating channels with the managers of the mining facilities. Ecos Mining also offers investors with unparalleled transparency of their mining activities by the use of live camera facilities and real time equipment surveillance systems.

The emphasis of the platform on institutional customers has led to superior security, regulatory guidelines, and reporting standards of financial information compared to the norms of the industry.

Advanced Security Protocols

Legitimate cloud mining platforms implement multiple layers of security protection:

-

All data transmissions and storage done using end-to-end encryption.

-

Multi-factor authentication where one has to verify several times.

-

Cold storage solutions that leave most of the funds offline.

-

Periodic security inspections by external cyber security agencies.

-

Policies against operational and security risks.

-

Regulatory compliance covering legal jurisdictions.

These comprehensive security measures work together to create robust protection frameworks that minimize risks associated with cloud mining investments while ensuring platform longevity and reliability.

Due Diligence Checklist

Before investing in any cloud mining service, conduct thorough research using these verification steps:

-

Check registration and licensing of the company.

-

Founders and backgrounds of the management team of research.

-

Examine third party security audit reports.

-

Review user feedbacks and community comments.

-

Check customer service sensitivity and expertise.

-

Study terms of contract and fee arrangements.

-

Establish evidence of actual mining activities and equipments.

Contract Types and Investment Options

Cloud mining websites come with a range of contract structures, which cater to those who have different investment objectives, risk risks and budgets. The knowledge of these alternatives assists investors with choosing the best mining strategies to adopt in their unique situation and market prospects.

Hash Rate Purchase Contracts

The most typical type of cloud mining investment is hash rate contracts, in which users can buy a certain quantity of mining power at pre-established times. Such contracts offer certain mining capacity and predictable pricing depending on the current market prices of the hash rate.

The key benefit of hash rate contracts is their simplicity and transparency - investors are aware of the amount of mining power they are buying and can estimate predicted returns based on what is happening with the network and at what price the cryptocurrency is trading.

The length of the contracts is usually one month to two years but long term contracts are known to have better prices per terahash at the cost of higher investments required and longer agreement periods.

Revenue Sharing Agreements

In other cloud mining platforms revenue-sharing models are available in which investors buy a portion of the profit of the mining facilities instead of buying a certain amount of hash rate. These structures give access to mining returns and the operational risks and rewards are shared with the operator of the platform.

Revenue sharing arrangements may be appealing to investors who desire predictable returns over variable mining payouts since minimum payout guarantees and constant incomes are frequent characteristics in contrast to the classical hash rate contracts.

Profitability Analysis and ROI Calculation

To analyze financial dynamics of cloud mining investments it is necessary to examine various variables that affect profitability and return on investment. The most effective cloud mining web sites platforms offer advanced calculators and analysis tools to enable its users to make professional investment choices.

The profitability of mining varies depending on the cryptocurrency market prices, changes in network difficulty, cost of operation and contract fee model. Effective cloud miners design strategies that take these variables into consideration and remain realistic in terms of returns to be achieved.

Profitability Factors Analysis

|

Factor |

Impact Level |

Variability |

Control Level |

|

Cryptocurrency Prices |

Very High |

High |

None |

|

Network Difficulty |

High |

Medium |

None |

|

Platform Fees |

Medium |

Low |

Platform Choice |

|

Contract Duration |

Medium |

None |

User Choice |

|

Market Volatility |

Very High |

Very High |

None |

ROI Calculation Methodology

Calculating return on investment for cloud mining contracts requires considering several key components:

-

Cost in the early stages of investment that comprises of all the charges and fees.

-

The allocation of hash rate and network conditions gives mining rewards every day.

-

Electrical and other maintenance deductions Operations.

-

Cloud mining service fees.

-

Duration of contract and the earning potential.

-

Reward values because of cryptocurrencies price volatility.

Realistic ROI calculations should account for worst-case scenarios and market downturns rather than relying on optimistic projections based on current market conditions.

Geographic Considerations and Regulatory Compliance

Regulation of cloud mining services is quite different in various jurisdictions, with some of the countries accepting cryptocurrency mining and others having stringent regulations or even prohibition. The US investors have to take into account the US regulations and the jurisdictions in which their adopted platforms exist.

The significance of regulatory compliance is growing due to the increasing number of governments throughout the world developing unified frameworks of the cryptocurrency-centered businesses. The valid cloud mining platforms are properly licensed and registered and adapt to the changing regulatory needs.

US Regulatory Landscape

American users of cloud mining websites must navigate federal and state regulations that impact their investment activities:

-

Capital gains and mining income tax reporting.

-

The securities laws that may concern some form of contracts.

-

Large transactions Compliance with the anti-money laundering (AML) laws.

-

Know Your Customer (KYC) verification stringent requirements

-

Different jurisdictions have different state-specific regulations.

Serious cloud mining investors also need to seek the services of a professional legal and tax advisor as the regulatory environment is still changing with new interpretations and enforcement measures of different authorities.

Mobile Optimization and User Experience

The best cloud mining website platforms have embraced mobile-first design principles, recognizing that users demand seamless access to their mining operations from smartphones and tablets. Mobile optimization has become a critical differentiator in attracting and retaining users in today's connected world.

Mobile applications provide real-time monitoring capabilities, push notifications for important updates, secure payment processing, and comprehensive account management features that rival desktop platforms in functionality and user experience.

Essential Mobile Features

Modern cloud mining platforms incorporate several key features in their mobile applications:

-

Real-time dashboards displaying mining statistics and earnings

-

Push notifications for important account and market updates

-

Secure authentication using biometric and multi-factor verification

-

Payment processing for contract purchases and withdrawals

-

Performance analytics tracking profitability and ROI metrics

-

Customer support integration with chat and ticketing systems

Risk Management Strategies

Successful cloud mining requires comprehensive risk management strategies that protect investments while maximizing profit potential. The cryptocurrency market's inherent volatility demands careful planning and diversification to weather inevitable market downturns and operational challenges.

Diversification strategies play crucial roles in risk mitigation, encouraging investors to spread their exposure across multiple platforms, cryptocurrencies, and contract types to reduce dependency on any single point of failure.

Risk Mitigation Approaches

-

Start small with initial investments to test platform reliability

-

Diversify across platforms to reduce operational risks

-

Monitor performance regularly to identify problems early

-

Maintain detailed records for tax and investment tracking

-

Stay informed about market conditions and regulatory changes

-

Set realistic expectations about returns and volatility

Customer Support Excellence

Exceptional customer support distinguishes the best cloud mining website options from mediocre competitors. Users frequently encounter questions about contract terms, technical issues, payout schedules, or account management that require prompt and knowledgeable assistance from support teams.

Quality support services include multiple communication channels, comprehensive knowledge bases, and responsive teams with deep understanding of mining operations and technical requirements.

Support Quality Indicators

-

Response times under 24 hours for email inquiries

-

Live chat availability during business hours or 24/7

-

Multilingual support accommodating global user bases

-

Technical expertise from staff understanding mining operations

-

Knowledge base quality with comprehensive FAQs and tutorials

-

Community forums enabling peer-to-peer assistance

Future Trends and Industry Outlook

The cloud mining industry continues evolving with technological advances, regulatory developments, and changing market conditions. Understanding emerging trends helps investors make informed decisions about long-term platform selection and investment strategies.

Innovation areas include artificial intelligence integration for optimization, enhanced security through blockchain-based smart contracts, environmental sustainability initiatives, and improved user experience through gamification and social features.

Emerging Technologies

Several technological developments are shaping the future of cloud mining platforms:

-

AI-powered optimization algorithms maximizing mining efficiency

-

Renewable energy integration addressing environmental concerns

-

Blockchain-based contracts improving transparency and automation

-

DeFi protocol integration enabling advanced financial products

-

Social trading features allowing users to follow successful miners

-

Enhanced mobile experiences through progressive web applications

Conclusion

The choice of the most suitable cloud mining site in 2025 will involve a great deal of scrutiny concerning the state of security, the ability to gain profit, compliance with the regulations, and transparency of operations. The platforms mentioned in this guide are the existing industry leaders having track records and innovative functions which can meet various risk tolerances and investment preferences.

Cloud mining requires research, diversification, expectations, and constant observation of your investments in order to be successful. The most optimal cloud mining services offer the clarity, safety, and assistance required to help explore this intricate asset investment environment without ensuring any dangers and the biggest payoff.

Cloud mining services provide convenient points of entry to an otherwise potentially profitable field, and whether you are a first-time cryptocurrency miner or are looking to expand your current holdings of digital assets. Plan the use of your platforms well, invest small sums to begin with to determine their reliability, and security and regulatory compliance should always be of priority when making decisions.

Frequently Asked Questions

1. Which cloud mining website offers the best returns in 2025?

The leading cloud mining site to get returns is based on several factors such as the price of cryptocurrencies, network difficulty, and the contract. Rocktoken and Ecos Mining are always among the most successful applications because these software has a high level of optimization and open fee policy. Nevertheless, there can never be a guarantee of returns and they are subject to market conditions.

2. How much should I invest in cloud mining as a beginner?

Novices ought to invest small sums of between 50 and 200 dollars to determine the stability of the platform and the mining process itself. The majority of cloud mining service providers permit small starting capital, so you can increase progressively as the time and confidence build. However, in the beginning, you must never invest what you cannot afford to lose.

3. Are cloud mining contracts safe investments?

When the due diligence is done on the reputable platforms, cloud mining services may be comparatively safe. Search on sites that have transparent business, are licensed, well-secured and those that have good reviews. Nonetheless, every cryptocurrency investment has risks such as market volatility, operational risks, and regulatory risks.

4. How do I calculate potential profits from cloud mining?

The profits of cloud mining should be calculated in terms of hash rate distribution, the prices of cryptocurrencies at present, network complexity, platform charges, and the duration of the contracts. The majority of the best cloud mining websites platforms have profit calculators, however, keep in mind that the prices of the cryptocurrencies and the intensity of the mining are continuously adjusting, which influences the real performance.

5. What red flags should I watch for when choosing cloud mining platforms?

Alternatively, you can avoid cloud mining websites that offer guaranteed returns, do not provide information about the company, have negative reviews, and force you with limited time offers. Legitimate cloud mining services have straightforward fee strategy, evidence of mining activities, license, and effective customer service. Never invest without first doing research.